Tax Rates Australia Resident . Can be an australian resident for tax purposes without being an australian citizen or permanent. Tax rates and thresholds summarised. about foreign resident tax rates. Read the tax rates applied to residents, foreign residents and working. Income from both australian and. Use these tax rates if you are an individual and were a foreign resident for tax. medicare levy surcharge income, thresholds and rates. Use the simple tax calculator to work out just the tax you. a resident individual is subject to australian income tax on a worldwide basis, i.e. With medicare levy included, the top marginal rate is 47%. this means you: the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below.

from www.alamy.com

the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. Income from both australian and. this means you: Read the tax rates applied to residents, foreign residents and working. Can be an australian resident for tax purposes without being an australian citizen or permanent. about foreign resident tax rates. medicare levy surcharge income, thresholds and rates. Use the simple tax calculator to work out just the tax you. With medicare levy included, the top marginal rate is 47%. Use these tax rates if you are an individual and were a foreign resident for tax.

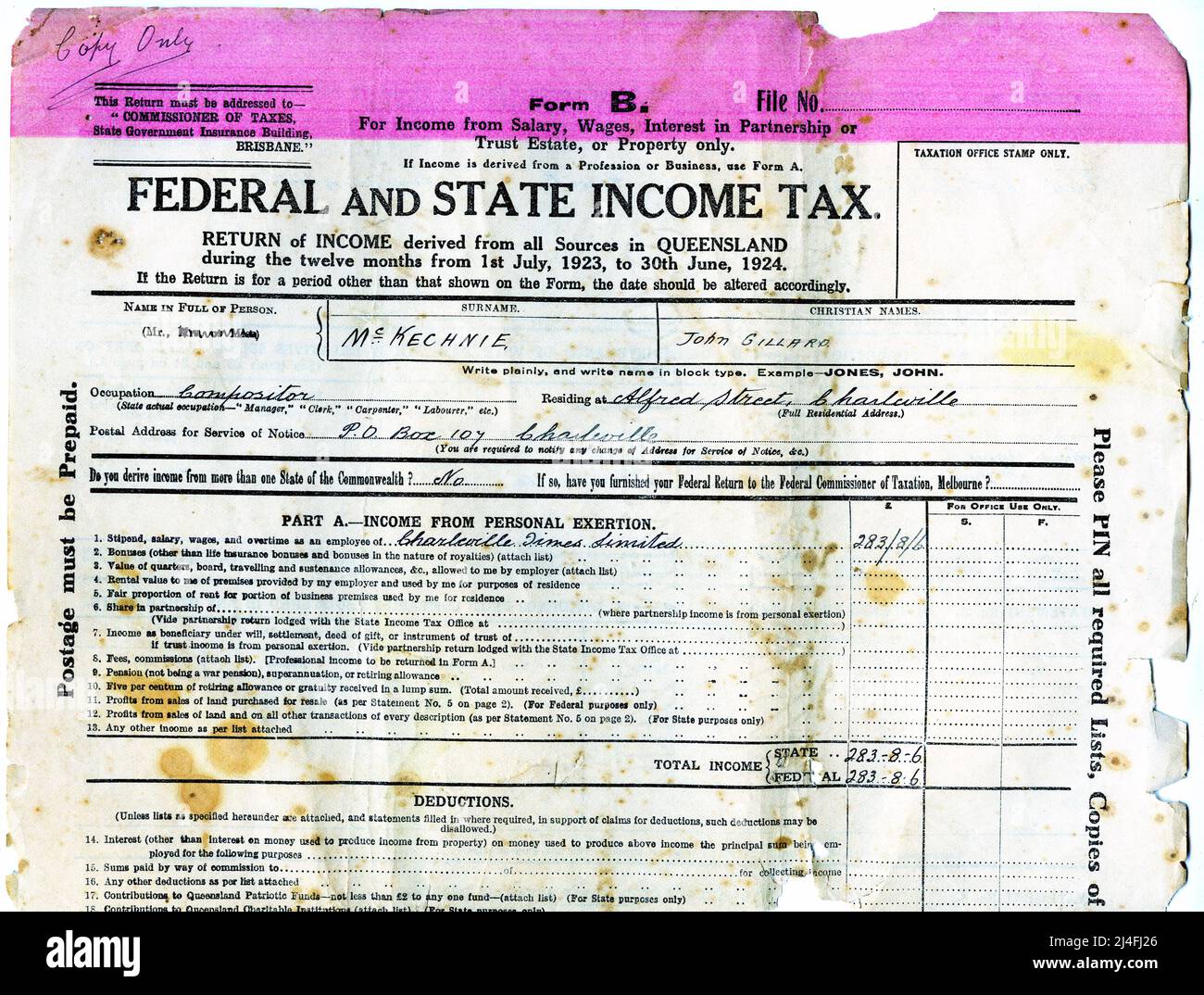

Federal and state tax form filled out for a resident in

Tax Rates Australia Resident the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. Read the tax rates applied to residents, foreign residents and working. Tax rates and thresholds summarised. With medicare levy included, the top marginal rate is 47%. the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. about foreign resident tax rates. this means you: Use the simple tax calculator to work out just the tax you. Income from both australian and. Can be an australian resident for tax purposes without being an australian citizen or permanent. Use these tax rates if you are an individual and were a foreign resident for tax. medicare levy surcharge income, thresholds and rates. a resident individual is subject to australian income tax on a worldwide basis, i.e.

From taxbanter.com.au

Tax residency rules to change — behind the Federal Budget proposals Tax Rates Australia Resident Read the tax rates applied to residents, foreign residents and working. the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. medicare levy surcharge income, thresholds and rates. this means you: Use the simple tax calculator to work out just the tax you. Can be an australian. Tax Rates Australia Resident.

From www.expattaxes.com.au

Determining Your Australian Tax Residency Status Expat Taxes Australia Tax Rates Australia Resident the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. Use the simple tax calculator to work out just the tax you. a resident individual is subject to australian income tax on a worldwide basis, i.e. Use these tax rates if you are an individual and were a. Tax Rates Australia Resident.

From www.chinalawinsight.com

Doing Business in AU丨Features of our Tax System China Law Insight Tax Rates Australia Resident the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. Income from both australian and. medicare levy surcharge income, thresholds and rates. this means you: With medicare levy included, the top marginal rate is 47%. Read the tax rates applied to residents, foreign residents and working. Can. Tax Rates Australia Resident.

From doriabeugenie.pages.dev

Tax Rates Australia 202425 Lexy Sheela Tax Rates Australia Resident about foreign resident tax rates. Tax rates and thresholds summarised. this means you: medicare levy surcharge income, thresholds and rates. a resident individual is subject to australian income tax on a worldwide basis, i.e. Can be an australian resident for tax purposes without being an australian citizen or permanent. Read the tax rates applied to residents,. Tax Rates Australia Resident.

From leannqsianna.pages.dev

Tax Brackets Australia 2024 Bria Marlyn Tax Rates Australia Resident Tax rates and thresholds summarised. this means you: Income from both australian and. about foreign resident tax rates. Read the tax rates applied to residents, foreign residents and working. medicare levy surcharge income, thresholds and rates. Use these tax rates if you are an individual and were a foreign resident for tax. the income tax brackets. Tax Rates Australia Resident.

From salary.udlvirtual.edu.pe

Tax Rates Australia 2024 2024 Company Salaries Tax Rates Australia Resident this means you: Use the simple tax calculator to work out just the tax you. Tax rates and thresholds summarised. Use these tax rates if you are an individual and were a foreign resident for tax. a resident individual is subject to australian income tax on a worldwide basis, i.e. medicare levy surcharge income, thresholds and rates.. Tax Rates Australia Resident.

From www.lifehacker.com.au

How Does Australia's Tax Rate Compare To The Rest Of The World Tax Rates Australia Resident With medicare levy included, the top marginal rate is 47%. Tax rates and thresholds summarised. Income from both australian and. Can be an australian resident for tax purposes without being an australian citizen or permanent. Use the simple tax calculator to work out just the tax you. about foreign resident tax rates. the income tax brackets and rates. Tax Rates Australia Resident.

From lidabyovonnda.pages.dev

Australian Tax Rates 2024 25 Audy Marget Tax Rates Australia Resident this means you: the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. medicare levy surcharge income, thresholds and rates. a resident individual is subject to australian income tax on a worldwide basis, i.e. Use these tax rates if you are an individual and were a. Tax Rates Australia Resident.

From giannabrigida.pages.dev

Tax Rates 2024 Nsw Elly Noelle Tax Rates Australia Resident Read the tax rates applied to residents, foreign residents and working. With medicare levy included, the top marginal rate is 47%. about foreign resident tax rates. medicare levy surcharge income, thresholds and rates. Can be an australian resident for tax purposes without being an australian citizen or permanent. the income tax brackets and rates for australian residents. Tax Rates Australia Resident.

From www.pherrus.com.au

How to Do A Tax Return in Australia Lodging FAQs Tax Rates Australia Resident Tax rates and thresholds summarised. a resident individual is subject to australian income tax on a worldwide basis, i.e. Use the simple tax calculator to work out just the tax you. Income from both australian and. the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. Use these. Tax Rates Australia Resident.

From americajosh.com

What's the deal with the proposed 2023 Australian Tax Residency Rules Tax Rates Australia Resident medicare levy surcharge income, thresholds and rates. a resident individual is subject to australian income tax on a worldwide basis, i.e. the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. With medicare levy included, the top marginal rate is 47%. this means you: about. Tax Rates Australia Resident.

From studylib.net

Form 164, Application for evidence of resident status in Australia Tax Rates Australia Resident Use these tax rates if you are an individual and were a foreign resident for tax. Can be an australian resident for tax purposes without being an australian citizen or permanent. the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. Tax rates and thresholds summarised. Use the simple. Tax Rates Australia Resident.

From au.icalculator.com

Australian resident for tax purposes, Explained Tax Rates Australia Resident Income from both australian and. Tax rates and thresholds summarised. the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. a resident individual is subject to australian income tax on a worldwide basis, i.e. medicare levy surcharge income, thresholds and rates. Read the tax rates applied to. Tax Rates Australia Resident.

From worldwideadvisory.au

Understanding Australian Tax Residency Worldwide Advisory Tax Rates Australia Resident Read the tax rates applied to residents, foreign residents and working. about foreign resident tax rates. With medicare levy included, the top marginal rate is 47%. Tax rates and thresholds summarised. Use these tax rates if you are an individual and were a foreign resident for tax. Can be an australian resident for tax purposes without being an australian. Tax Rates Australia Resident.

From www.studocu.com

Individual tax rates Australian Taxation Office Individual Tax Rates Australia Resident Read the tax rates applied to residents, foreign residents and working. Use these tax rates if you are an individual and were a foreign resident for tax. Tax rates and thresholds summarised. medicare levy surcharge income, thresholds and rates. the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed. Tax Rates Australia Resident.

From allywealth.com.au

New Tax Residency Rules A Breakdown for Australian Expats Ally Tax Rates Australia Resident Tax rates and thresholds summarised. Use the simple tax calculator to work out just the tax you. about foreign resident tax rates. Use these tax rates if you are an individual and were a foreign resident for tax. Read the tax rates applied to residents, foreign residents and working. With medicare levy included, the top marginal rate is 47%.. Tax Rates Australia Resident.

From elenabdominica.pages.dev

2024 Tax Brackets Australia Abra Kynthia Tax Rates Australia Resident a resident individual is subject to australian income tax on a worldwide basis, i.e. the income tax brackets and rates for australian residents for next financial year and subsequent financial years are listed below. Tax rates and thresholds summarised. With medicare levy included, the top marginal rate is 47%. medicare levy surcharge income, thresholds and rates. Income. Tax Rates Australia Resident.

From kapp-nae.blogspot.com

Australia Tax 2019 Tax Return forms for AY 2019 20 Tax Rates Australia Resident this means you: Read the tax rates applied to residents, foreign residents and working. a resident individual is subject to australian income tax on a worldwide basis, i.e. Use these tax rates if you are an individual and were a foreign resident for tax. Can be an australian resident for tax purposes without being an australian citizen or. Tax Rates Australia Resident.